What does the term due diligence mean?

The term due diligence is short for due diligence audit. This involves a careful determination of value and risk assessment. It is carried out when purchasing holdings in companies or real estate, but also for stock market flotations. The concept comes from American commercial and private law. In Germany, the term “gebotene Sorgfalt” (due care) is used in risk assessments.

The aim is to identify the strengths and weaknesses of a company. This is done regarding its commercial, legal, tax and financial circumstances and its risks.

When the Securities Act was passed in 1933, due diligence became standard practice (and a standard term) in the USA. Under this legislation, securities traders and brokers were held responsible for full disclosure of key information about the securities they were selling. If this information was not passed on to potential investors, dealers and brokers faced criminal prosecution.

An important check before deciding to buy

Before a purchase transaction involving a complex asset takes place, the buyer is made aware of the dangers but also the advantages associated with the purchase. By providing a so-called data room, the seller creates the basis for a sale. The data room includes all key data highlighting the risks, weaknesses, and strengths of the company. The information provided is selected on a voluntary basis. However, it should include full information about the existing risks. Depending on the relationship with business partners and the conditions of the purchase, various requirements are made of the due diligence.

Before a purchase transaction takes place, all the key data highlighting the risks, weaknesses and strengths of the company is presented in a data room.

Due diligence – an audit for specialists only

Audits of this sort play a key role in determining value and arriving at an agreement between buyer and seller. The two parties agree on the framework conditions for the due diligence audit. They may include payment of a fee if a purchase does not come about. Fundamentally, due diligence is carried out by experts and external consultants such as tax advisers, lawyers, auditors etc. During this audit, various sources of information are used. In particular, company documents and data are analyzed and meetings are held with the management of the target company.

The various types of due diligence audits

The focus of an audit of this sort depends on the situation and the individual case. Due diligence can be divided into the following areas of application:

Financial due diligence

Market and commercial due diligence

Tax due diligence

Operational due diligence

IT due diligence

Intellectual property (IP) due diligence

Onboarding and ongoing due diligence

Strategic due diligence

Human resources due diligence

Legal due diligence

To summarize:

buy-side due diligence

These types of cultural, technical, employee-related, and environmental due diligence audits are of increasing importance. Essentially all these areas can be brought together under the term buy-side due diligence. It can be described as a careful analysis to evaluate the suitability and main problems of a target company. There is usually a strong focus on the financial area, in which the historical and forecast results are set out.

Red flag due diligence:

identifying risks and deal-breakers

If a full scope due diligence is not possible, buyers often turn to a pure red flag due diligence. Here possible deal-breakers and large risks are identified for the transaction and ideally, they are excluded. A red flag due diligence also delivers results that can potentially reduce the price. The following areas are frequently investigated:

- Off-balance-sheet financial instruments associated with risk

- Inadequate or non-existent reserves

- A strained liquidity position that puts the existence of the company at risk

- Unrealistic planning assumptions

- Over-valuation of assets

- A decline in orders and revenue e.g., because contracts have expired

Red flags indicating a high risk in the purchase of a company include

Companies with a registered office

in a well-known tax haven or in a country with a high

Employees or partners

who have close contacts with (foreign) officials

Discrepancies on balance sheets

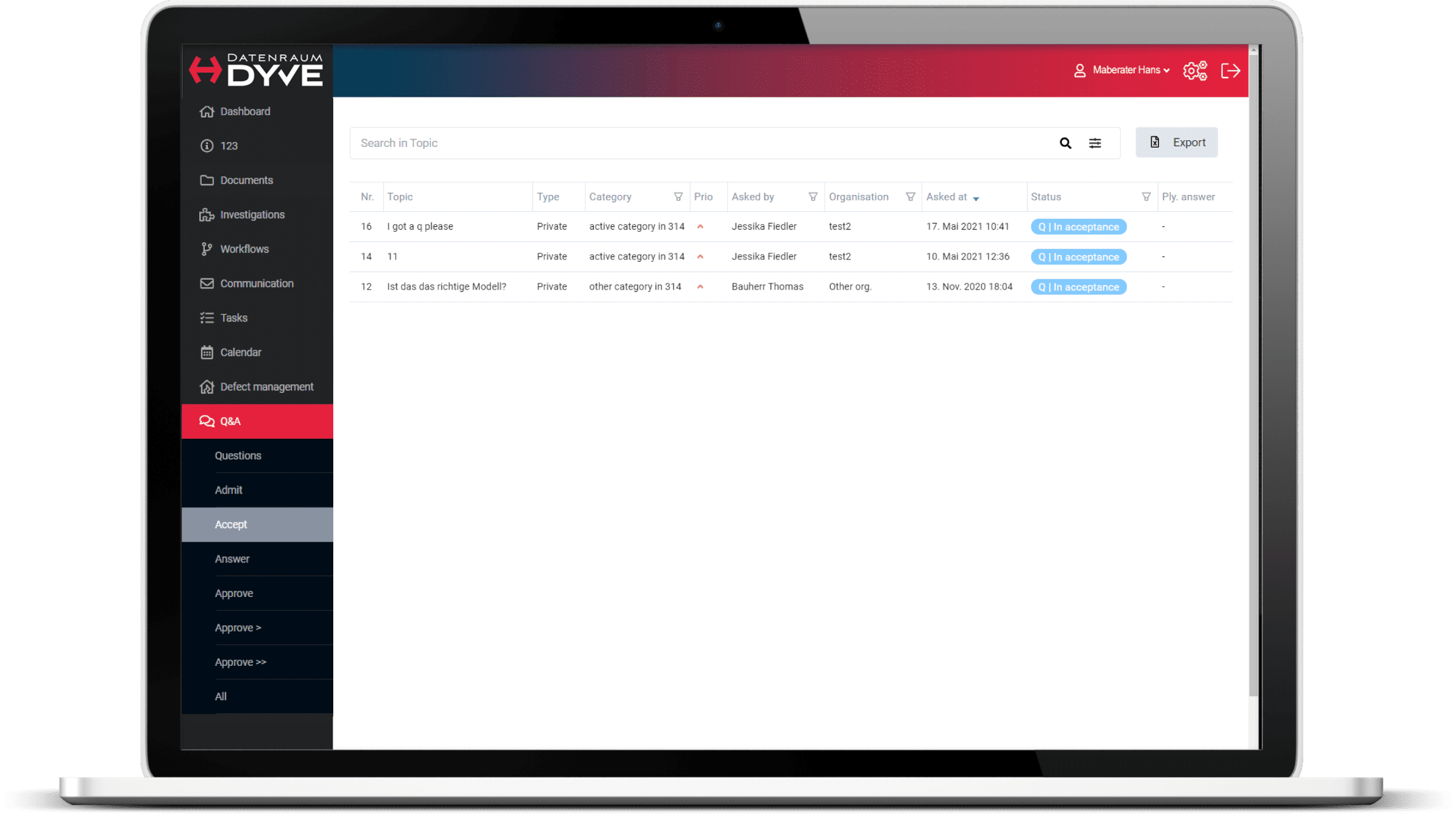

The DYVE digital data room

The turbocharger for your due diligence

PMG identified the way the wind was blowing at an early stage and developed the DYVE data room. The big advantage of due diligence in a virtual data room like DYVE:

A way of providing this information that works efficiently is extremely important for the successful course of the transaction.

Through audit-compliant storage of all file types and an integrated Q&A module, DYVE helps with the audit of company assets, strengths, and weaknesses. This module is an integral part of our DYVE data room. It helps you with clear and efficient M&As and due diligence audits. All parties can ask and answer questions through DYVE.

You control the process with gatekeepers, approval levels and access rights. The anonymity of bidders is preserved. Gatekeepers are specialists who are involved in answering questions. This allows precise management and control of the process by the seller. The latter can reject questions or assign them to the correct specialist. You can also group questions into priority levels and periods and assign your own quotas to the individual bidder groups at each level.

Risks

of digital due diligence

The move of due diligence to the digital world brings with it new risks and vulnerabilities. Armed security guards and theft-proof safes have now been supplemented by state-of-the-art cyber security systems that are prepared for attacks of any severity. Our DYVE data room also provides absolute reliability with servers in certified data centers in Germany with regular backups, vulnerability scans, temporary access rights with encryption and password protection.

Finally, our cloud solution logs all steps automatically in audit-compliant reports. The process can then be tracked at any time in the future. Quantifiable results feed into the company valuation and thus into the purchaser’s decision on the offer price. Unquantifiable results, on the other hand, lead to requests for indemnity clauses and guarantees in the company purchase agreement.

At first, the due diligence might seem unmanageable. But with our DYVE data room and its many useful features behind you, you will easily overcome the challenge.

Practical tip:

maintaining a data room

You should always maintain a data room so that you can act swiftly if you require finance in future or there is the possibility of an investment or transaction. When it comes to the next round of finance, you will already have everything in place and will be familiar with the digital data room. Save valuable time in the future and act now with DYVE.

Did you know that you can also get a digital introduction to DYVE from us free of charge in the form of a personal demonstration? Arrange a DEMO appointment now.

Server located in Germany

with AES-256 encryption and multi-factor authentication

DYVE is hosted in Germany, has multiple certifications, and is designed for fast, easy handling.

You can rest assured: our employees are bound by data protection regulations (Art. 29 GDPR) and a non-disclosure obligation for your data. This way, we ensure that all data protection and compliance requirements are met.